Benefit from our B2B card expertiseDesign your own card programmes and onboard all types of customers and complex businesses with our B2B knowledge.

Choose a white-labeled or fully embedded setupCustomise our platform in your own look, or integrate our features & services directly in your application.

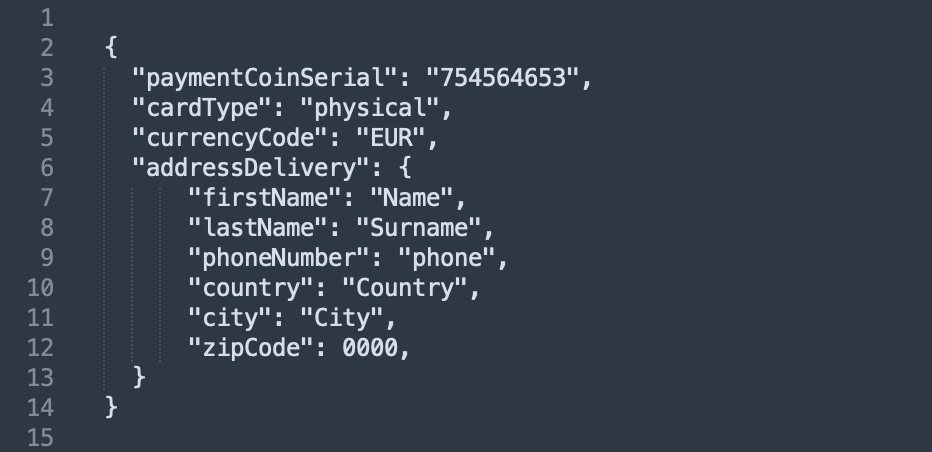

Rapid time to marketSet up best-in-class card solution with our easy-to-use API or out-of-the-box white-label offer.

Increase revenue without stretching your budgetDiversify your revenue base without making a large upfront investment or building your own risk, compliance, and payment ops teams.

Cards for all your needs

Prepaid cardsFlexible spending control, financial convenience, and security with prepaid cards, allowing users to manage budgets, make secure transactions, and enjoy the benefits of electronic payments without the need for a traditional bank account.

Travel cardsConvenient, secure, and cost-effective travel solutions, offering easy access to funds, favourable currency exchange rates, and travel-specific perks for a seamless and rewarding journey.

One-time cardsSecure, single-use payment solutions for enhanced online transactions, reducing fraud risks and providing a convenient, disposable alternative.

Expense ManagementSimplify financial control, streamline expense tracking, and enhance transparency for businesses through efficient spending controls, real-time insights, and automated expense management.

Loyalty programsBoost customer loyalty, increase repeat business, and drive brand advocacy with personalised rewards, exclusive offers, and a seamless, engaging experience.

Set up your own BIN rangeEmpower your brand with a dedicated BIN range, ensuring unique card identification, brand recognition, and enhanced control over card issuance and management.

Craft a cutting-edge card offering that businesses will love

Cards for all your needsIssue physical and virtual debit cards for different business use cases.

Frictionless card managementIssue cards and adjust limits in seconds, from anywhere and at any time.

Safe regulatory frameworkWe built a professional regulatory setup that you can trust at any time.

Real-time transaction dataEnable your customers to make informed decisions about spending limits, card usage, and accounting.

Compliance & risk out of the boxWe take care of the necessary compliance checks, and ongoing monitoring.

Dedicated second-level supportOur experts will assist you and your customers with any technical and payment-related challenge.